The offer you made on a home has been accepted and now you need to decide if a home inspection is necessary. Overall, the house may appear to be in good condition and you can always fix problems as they arise. Besides, it’s going to cost you hundreds of dollars to hire an inspector and you could really use that money to buy new furniture. Do you spend money on a home inspection or waive it?

A home inspection contingency clause (i.e. "due diligence contingency") is typically included in the buy-sell agreement you signed when you made an offer on a house. The contingency gives the buyer X number of days to obtain a satisfactory home inspection. If the results of the inspection are unsatisfactory, you can cancel the contract and recover their earnest money (if stated in the signed agreement). Or, the buyer can negotiate with the home seller to have them pay for all or a portion of the repair costs. In some cases, a buyer will agree to purchase the house "as-is", especially if they're competing against other offers. Waiving the inspection or agreeing to buy the house as-is, is favored by sellers as it speeds up the time to closing.

If you agree to schedule a home inspection, take advantage of the connections your real estate agent has so you won’t have to search for a home inspector, one who could be inexperienced. The home inspector will look over the home to see if there are any underlying issues that need to be addressed. For example, the furnace could be 30 years old and near the end of its life, there could be termite damage, or mold growing under the kitchen sink. If the cost of repairs are unusually high, the seller isn't willing to pay for them or provide credit, and you don't have money to cover them yourself, the contingency allows you to back out of the deal. You don't want to end up buying a money pit!

If you decide to get an inspection, you’ll want to consider more than one. Did you know there are at least 10 inspections available? Talk to your real estate agent to determine what types of inspections are essential.

- General Inspection

- Structural

- Foundation/Drainage

- Mold

- Roof

- Sewer

- Chimney

- Pool/Spa

- Termites

- Geological

A general inspection is most commonly performed when purchasing a home, but it isn’t necessarily going to find all problems within a property. You might want to hire a specialist, like a sewer or chimney inspector, to get detailed information about those often troublesome areas of the home.

Depending on the size of the home, you’ll likely pay $400 or more for a general inspection. Additional inspections, such as a termite inspection, will typically cost an additional $50 to $300. Talk to your real estate agent about the option to bundle inspections to save money.

Your real estate agent will be in charge of scheduling the inspections and sharing the results with you. Oftentimes, your agent will attend the inspection. You might want to attend the inspection as well so you have an opportunity to ask questions as issues are pointed out.

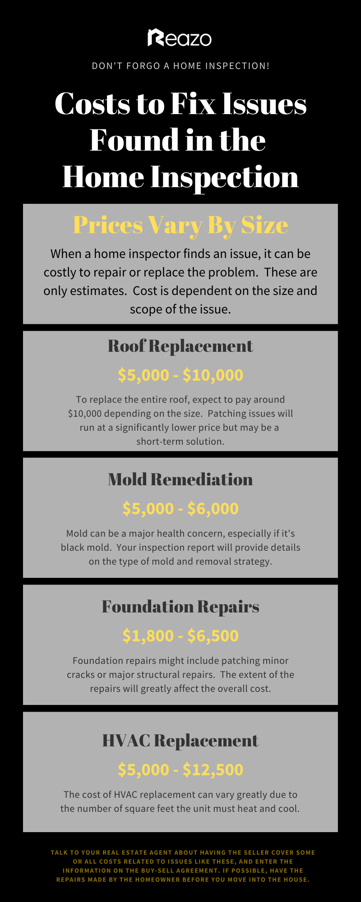

The results of the inspections will provide you with documentation of the problems with the house. Your agent will help you determine which repairs you might want the homeowner to make and if you want to request credit for other repairs. Although the seller doesn’t have to pay for repairs cited in the inspection report, you will have a better understanding of the condition of the home and whether or not you want to move forward with the purchase. See the illustration on the right to get an idea of the cost of common issues uncovered by home inspectors.

Conclusion

A home inspection gives you an opportunity to learn what's wrong with the home you're hoping to purchase. Ask your real estate agent to add a stipulation to the buy-sell agreement indicating your earnest money deposit will be refunded, if you're unsatisfied with the results of the inspection. You may use the inspection to simply learn more about the condition of the house but not ask the seller for any compensation to correct the issues. Or, you may ask the seller to reduce the price, provide credit to cover repairs, or ask them to make the repairs before closing. You also have the right to waive the home inspection and buy the house “as-is”. Discuss your options with your real estate agent and determine whether or not it’s worth it to waive the inspection.