When you're ready to buy a house, you might consider buying one from a family member so you can take advantage of the gift of equity. Are your parents thinking of downsizing? Is grandma ready to move into an assisted living center? The equity in your family's home could be used as a down payment, saving you thousands. Let's explore how the gift of equity works and how you could use it to purchase your next home.

When a home is worth significantly more than the mortgage balance, the difference is equity. The difference between the actual price of the home and the market value is the gift of equity. Equity increases over the years as the mortgage is paid down. If your parents, for example, purchased their home 25 years ago on a 30-year mortgage, 5 years would remain on their loan. Say the home is currently worth $300,000 and the loan balance is $80,000, your parents would have approximately $220,000 in equity. Your parents can gift a portion of that equity to you to put toward the down payment and/or closing costs. Not only will this make it easier to afford the home, but it will make it easier to get a home mortgage.

Pros for Buyer:

- Quick sale

- No PMI (except with a FHA loan)

- Low or no down payment

- Smaller mortgage loan

- No real estate agent, no commission payment

- Can be used with FHA, conventional, Freddie Mac, Fannie Mae loans

Cons for Buyer:

- Pay closing costs + associated expenses

- Pay taxes on gift

- Pay capital gains costs when selling home in the future

- Pay to have contract drawn up by a real estate attorney ($150-$200)

- Gift typically cannot come from anyone other than a family member

- Cannot use gift of equity with VA or jumbo loans

Besides using the gift of equity toward the down payment, the seller can drastically reduce the price of the home (well below appraised value) to provide the buyer with even more equity. For example, reducing the price of a $300,000 home to $250,000 gives the buyer $50,000 in instant equity. This is more than enough to cover the required down payment, other costs, and it lowers the mortgage loan amount.

Example:

$50,000 = gift of equity

$9,500 = closing costs (covered by gift of equity)

$40,500 = remaining equity and amount to be applied as the down payment

Thanks to the gift of equity, the buyer would only need to secure a loan for $209,500 ($250,000 - $40,500).

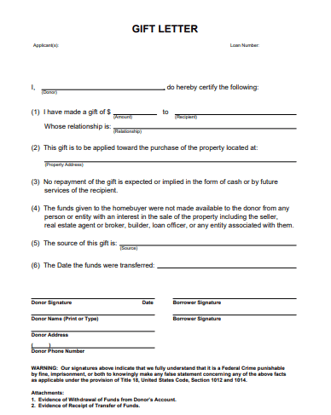

Gift of Equity Letter

To take advantage of the gift of equity, you will need to get a gift of equity letter from your lender. The letter must include the following information:

- Donor's name

- Address

- Phone #

- Amount of gift

- Relationship between borrower and donor

- Include "no repayment required"

- Signatures from both borrower and family member gifting the equity

Conclusion

As you can see, a gift of equity can save you a lot of money if you plan on buying a home from a member of your family. Use the gift of equity to cover closing costs and/or the down payment and lower the overall size of your mortgage loan. Your lender will have you fill out a gift of equity form which will need to be signed by both the seller and the borrower. With the gift of equity, the seller doesn't expect to ever receive repayment. Talk to your family and your lender about the gift of equity and soon you could be the next generation owning a family home, without a huge financial burden.

To learn more about equity and other financial tips related to buying or selling a home, please visit our finance page: