When you're preparing to sell your home, knowing how much equity you have can make your next home purchase that much easier. Imagine being able to use equity to pay off your current mortgage and have enough left over to make a decent down payment. Let's look at how you can build home equity and use it to buy a new home.

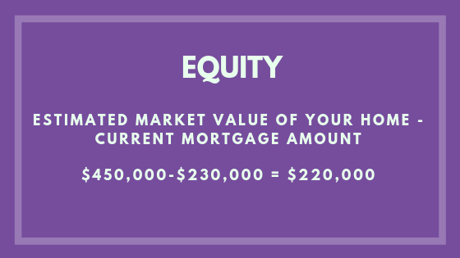

Equity is the difference between the home's fair market value and unpaid balance on all liens on your property. You earn equity in a variety of ways starting with a large down payment. As you make payments against the balance of your mortgage you continue to earn equity. The following are other equity earners:

- Refinancing your mortgage to a shorter term (15-year vs. 30-year)

- Paying more on your monthly mortgage (ex. $2,000 vs. $1,500)

- Interior home renovations

- Increase in area home values

- Landscaping

Having positive equity (aka: selling your house for more than you owe) can result in a tidy profit. On the other hand, if you sell it for less than what you owe, you're in a negative equity position. As the name implies, this is not in your favor. With negative equity, you would be faced with a short sale situation should you decide to sell. In this case, it would be worth it to hold off selling until you're in a better financial position.

Let's assume you have positive equity in your home. As you aim to use equity towards a new home, it's important to understand equity isn't all profit. For example, if your home is appraised for $450,000 and you owe $230,000 (remaining mortgage), you would have $220,000 worth of equity in your home. If your home sells for the appraised price, you'll profit at closing. Other fees will cut into the profit including real estate agent commission fees and mortgage closing costs. The remaining profit can be used as a large down payment on your next home.

You have a few options for determining the current value of your home including looking online, a CMA, or getting a professional appraisal.

You have a few options for determining the current value of your home including looking online, a CMA, or getting a professional appraisal.

- Although it might be tempting to go online to figure out the value of your home, online value estimates aren't always accurate. Comparing your home to similar homes that have recently sold in your neighborhood can give you a better idea of what your home might be worth.

- Ask your real estate agent to provide a comparative market analysis (CMA)

- Get your home professionally appraised by a licensed real estate appraiser (most accurate option)

When looking at home values online, you need to be aware that sold prices are not reflected accurately all of the time. Most websites use algorithms or calculators to estimate values and sold prices. Accurate sold prices can only be obtained from your local Multiple Listing Service (MLS), which can only be accessed by a licensed real estate agent/Realtor®/broker.

Once you know the value of your home, subtract your current mortgage balance from your home's value to get a better idea of the amount of equity you have in your home. If the current value of your home isn't as high as you had hoped, which would result in minimal profit, you might hold off until you built up more equity. For example, make more improvements to your home, pay down the mortgage a considerable amount, and/or wait until home values have increased significantly.

Want to stretch your home equity further? If you're at a point in your life where you can downsize, a smaller home will allow you to get more from your equity.

NOTE: Certain types of mortgages, like an interest-only or other non-amortizing, will not reduce your principal balance or build equity. With these types of mortgages, your payments pay interest, property taxes and insurance only.

Conclusion

There are many ways to build equity in your home including paying more than is required on your monthly mortgage a few times a year and renovating the inside of your home, among other suggestions provided in this article. To figure out how much equity you have in your home, start by learning how much your home is worth. With enough equity, you could purchase of your next home with a large down payment. Reach out to your real estate agent today to see if this is a good time to sell and use the equity in your home. If you don't have an agent, we can help. We have connections with real estate agents across the U.S. and in Canada. Click the "Get Connected Today" button below.