Table Of Contents

- Introduction to Home Finance

- Can I Afford to Buy a Home?

- Mortgage

- Benefits of Being a First-Time Home Buyer

- Getting Your Finances in Order

- Lender Criteria

- Ways to Finance a Home

- Down Payments

- Extra, Unexpected Costs

- Lender Credit

- Closing Costs from Seller

- Discount Points

- Financing Dwellings, Other Than Single-Family Homes

- Good To Know

- Conclusion

1. Introduction to Home Finance

At Reazo, we understand homeownership is a big commitment and home financing can be confusing. Through Reazo’s in-depth research, we aim to help home buyers better understand and be less fearful of what it takes to finance a home. We arm you with as much knowledge as possible to ensure you’re making the most educated decision when financing your first home (or second). Ultimately, we aim to make you a real estate expert.

Only you know when you’re ready to buy your first home. Forget that your friends are buying houses, interest rates are the lowest they’ve been in years, you’ve rented forever and feel like you’re throwing away your money each month on rent, or your parents think it’s a good time for you to purchase a home. There is a lot to consider as a potential first-time home buyer and the more prepared you are, the higher the likelihood of making the best decision when you are ready to buy a home.

Educate yourself with the information below and you’ll walk away with a firm understanding of the financial side of home purchasing. Learn about loan options, grants, equity, homeowners insurance and more. Buying a home is the biggest investment you may ever make and probably the biggest up until this point in your life. Let’s take a look at everything you need to know about the financial side of home buying so you can purchase your first home.

2. Can I Afford to Buy a Home?

From Renting to Buying

If you’ve been renting and are contemplating homeownership, it’s important to take a look at the pros and cons of renting vs. buying (even if you aren’t a renter, this information may prove helpful). Consider the following as you begin your quest to become a first-time home buyer:

- Cost of renting vs. buying

- Size of your savings account

- Building equity

- Repairs

First, consider the cost of renting vs. owning a home. If you’re already renting for $1000/month and you pay approximately $200/year in renter’s insurance plus utilities, your average fixed monthly payment might be around $1350. After looking at homes online, you may have come to the realization that you could be making a monthly mortgage payment for a similar amount and you would own a house.

There are additional expenses associated with buying a house which must be taken into consideration. Some of these expenses include the down payment, homeowners insurance, private mortgage insurance (PMI), closing costs, moving expenses, and more. In addition, you’ll be paying for property taxes, possibly HOA fees, water, sewer, gas, garbage, higher utilities than you’re currently paying due to more square footage, the need to buy furniture and paint, etc. In a nutshell, the amount you see online for a mortgage payment is only a portion of what you’ll actually be paying once you buy a home.

Savings Account

Consider how much you have in savings, as you look toward homeownership. Do you have enough saved for a 20% down payment? Let’s say you’re pre-approved to buy a $375,000 home. A 20% down payment, which lenders prefer, would cost you $75,000 at closing. If you don’t have enough saved, and can only pay a small down payment (minimum is usually 3% down), you will end up paying for private mortgage insurance (PMI) on most conventional mortgage loans. In addition, 2-5% of the purchase price will go toward closing costs, but the seller may offer to pay for all or a portion of cost.

$375,000 Cost of Home + Additional Fees:

+ $11,250 Down payment (3%)

+ $3,637.50 Annual PMI

+ $7,275 Closing costs

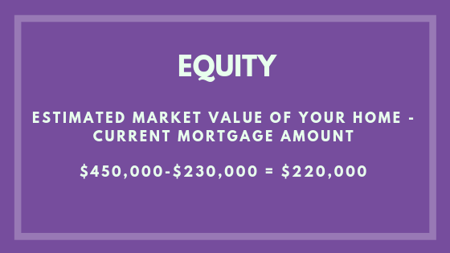

Equity

When you buy a home you build equity, which is not the case when you rent. Equity is the amount of your home that you actually own as a result of mortgage payments and appreciation (fair market value of your home minus the loan balance). As a renter, you are not going to build equity from the deposit and the first/last payment you had to put down when you signed the rental agreement, let alone your monthly rent payments. You can kiss that money goodbye.

Making a large down payment will instantly build equity in your home. Aim for at least 20% down. As you pay your monthly mortgage payments, you continue to build equity. If you can make extra mortgage payments, you’re not only going to build equity quicker, you’re going to save on the interest that would have been charged on those payment down the line.

If you have a 30-year mortgage, refinancing to a 15-year mortgage can help you build equity too. Not only will you pay off your home in half the amount of time (paying more per month), you will save on the interest that would have been charged on those extra months and years of payments.

As you build equity, you will be able to tap into it to renovate your home or even use the money for other financial objectives. The renovation will help build more equity in your home as it will increase the value, in most cases. Ask your real estate agent which renovations will bring the highest return.

If the market denotes a higher home value, this also provides an opportunity to build equity in your home. For example, say your home was worth $300,000 when you purchased it and years later it appraises for $350,000. If you had paid down your mortgage to $280,000, you would have $70,000 in equity ($350,000 minus $280,000).

Repairs

Consider what happens when you have an issue in your home or apartment, something that requires a repair. As a renter, if you have a problem with a leaky sink or mice, for example, you call the landlord and he/she takes care of the issue and covers the cost. When you own a home, you are in charge of fixing the sink and getting rid of the mice -- you are your own landlord. As a homeowner, you cover the cost of repairs or the expense of hiring someone to make the repairs. This is a component of homeownership worth considering if you plan on buying a home.

After looking at the cost of renting vs. buying, the size of your savings account, and building equity in a home, there are other reasons you might want to buy a home:

- Home values are on the upswing (you’ll quickly build equity in your home)

- Home prices are low (buy low and sell high in the future)

- Home costs are predictable vs. rent increasing over time

- You want to live in the same place for more than a couple of years

- Option to rent out part of your home, or your entire home

- Interest and property taxes are tax deductible

- Pride in ownership

- Privacy

As you can see, there are incredible benefits to owning a home like building equity, and drawbacks like more expenses and becoming your own landlord. Let’s move on and take a look at which loan options are available to compliment your financial position.

3. Mortgage

The majority of buyers will not have enough savings to pay all cash for their home -- that’s where mortgage loans come into play. What is a mortgage? A mortgage is a loan used to buy a home, and the home is then used as collateral. The loan is an agreement with your lender to borrow cash for the purchase of a home, and then you make monthly payments until the loan is paid in full.

To get a better understanding of mortgages, let’s look back at their evolution. Mortgages have been around since the 1930’s and were mainly utilized by insurance companies. These companies hoped to gain ownership of properties if owners failed to make payments. In 1934, the mortgages that we’re familiar with today came about, mainly due to the Federal Housing Administration (FHA). In an effort to pull our country out of the Great Depression, the FHA initiated a new type of mortgage for those people who were unable to obtain mortgages under existing programs. Less than half of households owned homes at that time and the government wanted to change that. Before the FHA made changes, loan terms were limited to 50% of market value, and loans had to be repaid in 3-5 years with a balloon payment at the end.

The FHA started offering mortgages with lower down payment requirements and programs with a 80%+ loan-to-value (LTV) ratios (LTV is a lending risk assessment ratio used by financial institutes and lenders to approve a mortgage). The length of the loan terms was changed from 5-7 years to 15-years, eventually offering 30-year loans that we’re familiar with today. Suddenly more people could afford to own a home. The FHA also set quality standards for home construction and established the amortization of loans. People could now pay incremental amounts of the loan’s principal amount with each interest payment. The amount of the loan was gradually reduced over the loan term until it was fully paid off.

Today there are many mortgage and financing options available because the government wants you to buy a home to keep the economy moving. Home buying also combats transiency, strengthens communities, helps people invest in their future and generally contributes to a higher quality of life. Before we dive into the various mortgage options available today, let’s look at the importance of getting pre-approved for a loan.

Getting Pre-Approved / Pre-Qualified for a Mortgage

Now that you have a better idea of what a mortgage is, let’s look at what it takes to get pre-approved or pre-qualified for a mortgage loan and why it’s important.

To get pre-approved or pre-qualified for a mortgage loan, you’ll need to visit a lender. You might start out by asking friends who their lender was and if they would recommend them. From there, you could talk to your bank, competing banks, and credit unions. If you already use a mortgage broker, talk to him/her about lender recommendations. If you choose an online lender, know that you may be required to meet with the lender in person to complete the pre-approval process or pre-qualification process.

Depending on the lender, you may be charged a fee to get pre-approved or pre-qualified. Some lenders will charge an application fee, others will waive it to entice borrowers to use their services. Before submitting your application, ask your lender about fees. If you are charged a fee, some lenders will roll it into your closing costs.

The process of getting pre-qualified for a mortgage loan is less extensive than getting pre-approved. Pre-qualification is a general, overall review of your financial standing (ex. income, debt, possibly your credit history) and can be determined with a lender over the phone. The pre-qualification states that you are most likely qualified for a loan and indicates the amount the bank might be willing to lend you. A pre-qualification letter gives you an estimate of how much you can borrow and is a good starting point as you begin to look at homes.

Getting pre-approved gives you a price range so you know what you can afford. This will save you from wasting time looking at house you could never afford to buy. When you start the pre-approval process, your lender will look closely at documents such as pay stubs, bank accounts, tax returns, W-2’s, assets, credit information, monthly expenses, divorce decree (if applicable), and self-employment documentation, among others. The lender will look at your income (debt-to-income ratio; explained in more detail later in this article), credit score and overall financial standing to determine what type of loan you qualify for, the maximum loan amount, and the interest rate. Remember to bring a valid form of identification (driver’s license or passport).

When you get pre-approved for a mortgage, your lender is confident you have the means to make a down payment and you have the income to support monthly mortgage payments. Despite the pre-approval letter, the house you desire will have to be appraised. The amount of the appraisal must be more than or equal to the purchase price. If the purchase price is higher than what you’ve been pre-approved for, you will not be able to purchase the home.

If you want to be pro-active, you can start by taking a look at your credit reports and credit score before seeking a pre-approval letter. This will give you some insight on the types of loans and interest rates you might qualify for. If you find any problems with your credit report, now is the time to take care of them.

It will take 2-4 weeks to get a pre-approval letter, in most cases, and it will be valid for 60-90 days (varies by type of loan). There will also be a charge associated with it in most cases. You will be approved for a specific loan amount but you do not have to buy a home at that price. The loan amount is simply the maximum amount you’re pre-approved for, but it’s wise to purchase a home below that amount so you have money for other expenses.

Even when you get pre-approved, it is not a guarantee. Your real estate agent will want to know what a lender thinks you can afford so he/she will favor a pre-approval letter over a pre-qualification letter. Regardless, your agent and sellers will take you more seriously if you’ve been pre-approved for a loan due to your creditworthiness.

Once you’ve made an offer on a house, your lender will go through the final approval process. This will take much longer than the pre-approval process. Ask your lender for more information about this final approval to avoid any surprises. An underwriter will determine if you meet the lender’s guidelines and receive final approval. Once you’ve been approved for a mortgage loan, you will receive a letter that you can share with your real estate agent.

Note: your loan approval can be revoked if you make a large purchase, like buying a new car, before closing. It’s wise to avoid making any large out-of-the-ordinary purchases, especially on your credit card, and avoid signing up for any new accounts while waiting for the final approval.

Getting pre-approved is beneficial and can help you get into a home faster than without pre-approval. Other reasons to get pre-approved for a mortgage include the following:

- You’ll know exactly what you can afford and what you cannot

- Saves time: you aren’t wasting time looking at houses you can’t afford

- Avoid the disappointment of finding a home outside of the price range you’re qualified for

- Your real estate agent will ask for, and prefers, a pre-approval letter

- Gives you an advantage over buyers who haven’t sought pre-approval

- Makes you aware of issues that exist with your credit and gives you time to correct them

4. Benefits of Being a First-Time Home Buyer

There are advantages to being a first-time home buyer that aren’t available to return buyers. For instance, you will have access to special loan programs that can get you into a home quickly and affordably. Some benefits include low down payments, subsidized interest, and fewer lender fees. Imagine only paying a 3% down payment, compared to the lender recommended 20%. Regarding interest, there are 3rd parties available who can pay for loan interest, saving you a significant amount over the life of your mortgage loan. With options like these, mortgage loans are more affordable and enable you to pay off the loan much faster. (More information provided below.)

Qualifying As a First-Time Home Buyer

If you don’t think you qualify as a first-time home buyer because you’ve owned a house in the past, there are some important facts you should know about. In some cases, a first-time home buyer is defined by whether or not you owned a home in the last 3 years. In other words, you could become eligible as a first-time home owner despite the fact that you’ve owned a home in the past. Other factors that can qualify you as a first-time home buyer include the following:

- If you are a single parent, who only owned a house with your ex when you were married

- If you are a displaced homemaker who only owned with a spouse

- If you owned a principal residence that was not permanently attached to a permanent foundation in accordance with applicable rules

- If you own a property that did not comply with state, local or model building codes and that cannot be complied with for less than the cost of building a permanent structure

Talk to your real estate agent or lender to see if you qualify as a first-time home buyer despite the fact that you owned a home in the past.

5. Getting Your Finances In Order

In order to figure out what you can afford, start by getting your finances in order. As mentioned earlier, look at how much you have in savings and how much can you contribute to a down payment. It’s best to start saving for a down payment early, long before you decide on the house you wish to buy. Lenders typically recommend putting 20% down which will lower your monthly payment amount and you won’t have to buy private mortgage insurance (PMI: insurance intended to protect the lender in the event of foreclosure if you fall behind on payments.).

As a first-time buyer may only need to put 3% down on a home, depending on the loan. If you’re qualified to purchase a $200,000 home, you would pay a $6,000 down payment at 3%. At 20%, you would pay $40,000 down. As you can see, not only will you save a significant amount of money with a lower down payment, you will get into a home quicker. Let’s look at other financial components essential to the home buying process.

FICO/Credit Score

When you look at your credit rating or FICO score, you’re not only looking at the number but how accurate the information is. If you suspect any errors, report them to the Consumer Financial Protection Bureau (CFPB). Errors on your credit report could make you appear risky to lenders, and in turn, make it difficult to get a loan, better lending terms and interest rates. Common errors might include a clerical error when someone entered your information incorrectly from a hand-written application. In some cases, a loan or credit card payment may have been applied to the wrong account inadvertently. Contact your credit bureau (Experian, Equifax, or TransUnion) and the organization who made the error. Filing a dispute online will probably be the most efficient way of getting the issue corrected. You may want to ask to be copied on any correspondence as they work to resolve the issue so you have a record of the rectification. Once they have corrected the inaccuracy (30-90 days), you will want to look at your credit report to verify that the information has indeed been updated. Your credit bureau will most likely provide a free credit report once the dispute has been recorded. Now that you know your credit score is accurate, let’s look at how it rates.

Your credit card debt and other outstanding debt greatly affects your credit score and whether or not a lender will provide a loan. Credit scores generally range from 300-850. 700-749 is considered an excellent score while 300-649 is considered poor. The higher the score, the least amount of risk in the eyes of your lender. If you have a low credit score, your lender will probably encourage you to work to increase it before loaning you money.

Another important point when it comes to getting your credit score from the internet… it may not be accurate and you should only consider it a starting point. The only credit score that really matters is the credit score you receive from your lender. Once you receive your lender-generated credit score, you will know exactly what type of loan you qualify for. Also, if you need a better credit score to qualify for the loan you’re seeking, you can get assistance to improve your score.

Credit Utilization Rate

Since the amount owed on all of your credit cards effects 30% of your credit score, aim to pay down balances to 30% or less, as recommended by FICO. Be aware of your credit utilization rate (aka: credit utilization ratio). This rate is the amount of revolving credit you’re using divided by the revolving credit available to you (lenders will look at this when analyzing your credit score). For example, if you have 2 credit cards with $10,000 combined credit available to you, one with a balance of $100, the other with a balance of $8,000, your credit utilization rate is 81% ($8,100 / $10,000). Lowering the balance will lower the percentage, making it more favorable for you to qualify for a loan.

Per-Card Utilization Rate

Per-card utilization rates are also considered by lenders and reflect how well you’re managing your finances. This is similar to the way the credit utilization rate is calculated but it compares the balance of an individual credit card to the available credit on that card. In the $10,000 credit limit example above, a $100 balance vs. a $8,000 balance results in a 1% and 8% per-card utilization rate, respectively. Again, keeping your credit utilization rate below 30% is commonly recommended by FICO.

Boost Your Credit Score

When trying to get approved for a mortgage, it’s important to have a good credit score. If you’re score is less than desirable, you can work to improve it and qualify for a more favorable loan and lower down payment. Improving your score translates to paying off your mortgage faster by saving money on finance charges and interest rates.

Lending institutes want to make sure you’re trustworthy and high credit scores earn their trust. When you have a high score, lenders view you as someone who can handle your finances and meet financial obligations. They’re more likely to lend you more money towards the purchase of a home and give you a better interest rate. For example, having a score 100 points higher than what you have now could earn you a 1% lower interest rate. Might not sound like much until you realize it could save you more than $12,000 over the life of a $300,000 loan.

To boost your credit score, the following options are important to consider or try one of these options:

- Call your credit card company to have a recent late payment fee forgiven

- Aim to pay down credit card balances to 30% or less

- Work to pay off maxed-out credit cards

- Charge something small to rarely used or inactive credit cards then pay off card

- Consolidate credit card debt

When you forget to make a credit card payment and are faced with a late fee, pay the past-due balance right away. By paying the outstanding balance quickly, you minimize long-term financial damage. It’s much less likely the late payment will show up on your credit report or jeopardize your credit score if you pay shortly after it’s been posted as past due. Keep in mind, a tardy payment doesn’t result in merely a late fee; your credit card company can raise the interest rate on your credit card too.

Waiting more than 30 days to pay the credit card balance and other fees will result in a black mark on your credit report for 7 years. Just one late payment will drop your credit score a considerable amount and ruin otherwise excellent credit.

At 180 days past due, your credit card balance can be turned over to collections. Do everything you can to prevent this from happening because you’ll end up with a black mark on your credit score for 7 years, even if you pay off the amount due to the collections agency. In addition to paying the card balance, you will have to pay fees to the collections agency.

Let’s back up and look at how you can get the late fee waived. If it’s unusual for you to miss a payment and accrue a late fee, you’ll have a good chance of the credit card working in your favor. Give them a call and explain your circumstances (be honest). Every credit card company is different, but most will waive the late fee as long as it’s rare for you to have a late payment. Some companies will allow you to wait the late fee up to 2x per year (every 6 months). Other companies may require you to sign up for automatic payments before they’ll waive the late fee. Talk to your creditor to see what options exist so you can maintain a good credit score.

Paying down your credit card balance is also favorable in improving your credit score. The general rule is to pay the balance down to less than 30%. Paying off a maxed-out card is going to have a greater impact on your credit score than if you’re paying off a card with balance of $3,000 with a $5,000 limit. This is because credit bureaus are looking at your credit-to-debt ratio. Slowly pay off a maxed-out card will gradually increase your score. If you want to see the fastest improvement in your credit score, it’s best to pay off the card in its entirety vs. paying it off in small amounts over a long period of time.

Also, as you’re paying down credit cards, consider asking your credit card company to lower your interest rate. If you’re consistently making payments and significantly lowering the balance, creditors are more likely to consider your request. This will save you a lot of money as you pay down the remaining balance.

Consolidating your credit card debt with a personal loan will not only help you effectively manage your debt, it can improve your credit score. In other words, all of your debt would be rolled into one loan. Getting a personal loan with a fixed rate, that’s lower than that of your credit cards, will save money over the long haul and help you pay off the debt faster. Less debt leads to a lower credit utilization score which leads to a higher credit score. Through consolidation you only have one monthly payment, making it easier to pay on time which, in turn, will boost your credit score.

If you decide to consolidate your credit card debt, the creditor will pull your credit report (a “hard pull”) to qualify you for a loan. This adds an inquiry to your credit report which will drop you credit score slightly and briefly. Fortunately, the debt consolidation will reduce your utilization which ultimately increases your credit score. If you want to avoid a drop in your credit score, it’s best to get prequalified for a loan. Getting prequalified results in a “soft pull” of your credit report which does not result in an inquiry on your credit report. Another benefit of getting pre-qualified before consolidating your debt is the option to shop around for the best rates.

You might even consider hiring a credit repair company to help remove black marks on your credit score. These companies can remove late payments, liens, repossessions and more from your credit record making it easier for you to qualify for a home loan and favorable interest rate. They will even communicate with your credit card company(ies) on your behalf. Many of these companies charge a fee but may also offer a free consultation and possibly a money-back guarantee. Consider this, the amount you’ll pay for their services may be insignificant compared to the amount you’ve been paying in late fees and high interest rates.

Consider using a credit analyzer tool to help determine the quickest way to pay off credit card debt based on the amount of money you have. A credit analyzer can help you understand which factors are impacting your credit score, ways you can improve your credit score, and how to save money so you can buy a home. This can be a great tool for estimating monthly house payments and saving for a down payment. You’ll also learn how to avoid common credit mistakes. This tool is free in some cases and a variety of options are available online.

If you have a rarely-used credit card, you can use it in favor of a better credit score. Making small purchases then paying off the card right away will improve your credit score. Credit reporting agencies take into account the length of time you’ve had a credit card too, so check to see how long you’ve owned this card. The longer you’ve owned the card, the more it helps your credit score (as long as there isn’t a balance). If you’ve had it in your possession for years, merely holding onto it without making a purchase can benefit your credit score.

It’s worth noting that closing a credit card can negatively affect your credit score by changing your credit utilization ratio. Credit reporting agencies look at the amount of credit you have available through your credit card(s) and the more you have available to you, and the less you use it, the more favorable it is for your credit score. In other words, having a lower balance-to-credit-limit ratio, is rewarded when you have an unused credit card.

Here’s something else to consider if you want to close a credit card. If you don’t pay off the balance before requesting the cancellation of your credit card, the credit card agency might bump up your interest rate to the maximum allowable by law just to penalize you. Pay the balance down to zero, contact your credit card company to confirm the balance is zero, then request the cancellation. Ask to get the cancellation in writing, via email or snail mail. By the way, if you have numerous credit cards, don’t close them all at once. Doing so will change your credit utilization ratio and negatively affect your credit score.

If you don’t have a credit card, now is the time to get one. You need credit accounts reported to your credit report in order to improve your credit score. No credit is bad credit. Open a credit card, use it once in awhile (low-priced purchases) and pay it off monthly. Cards with high limits play in your favor when it comes to your credit score.

Compare Mortgage Rates

Once you’ve determined your credit score will be good enough to get pre-qualified for a loan, take time to research the best mortgage rates. You can start by going online to find mortgage rate calculators that will provide a variety of rates from various lenders. These rates will be based off of your target home price, the amount of your down payment, the loan type, and your credit score but may include other factors. Keep in mind, most of the online results will be for the top banks only yet many more options exist.

Take your time while shopping online for mortgage rates. Look at customer reviews, ratings, and comments. All of this can save you from a bad experience and wasted time. Be aware of bank and mortgage apps that quickly approve you. These apps may also limit you to few loans options. You might find a better rate by shopping locally or online. When you find a good rate and bank online, know that you may be required to sit down face-to-face with a mortgage broker.

You may find a better mortgage rate by visiting your local bank or credit union. If you’re unsure what type of a loan you qualify for, start by visiting the bank you’re currently using for your checking/savings account. Don’t feel obligated to use them as your lender, unless they have the best mortgage rates.

Mortgage rates can vary week by week. It’s important to find an interest rate that is low to save yourself mounting interest as you pay off your mortgage. The larger the loan, the more you’ll notice the amount of interest growing over the life of the loan. For example, imagine having a 30-year mortgage loan at 5.9% interest. On a $300,000 mortgage, you would be paying somewhere around $17,700 the first year in interest. The same 30-year mortgage at 3.25% would drop the interest to around $9,750 the first year. As you can see, a low rate can save you thousands of dollars a year.

When you find a good mortgage rate, talk to your lender about locking it in place (known as a rate lock) and the rules associated with it. With a rate lock, you may get locked into a specific type of loan and/or may not have an option to take advantage of a lower rate should the option become available. A rate lock is a great way to protect yourself against market fluctuations. If rates go up while you’re locked in, your rate will not be affected while you wait to close on your loan. Locking in your rate will save you from spending additional money on interest each year (could save you $100’s or $1000’s annually). You will typically take advantage of a rate lock after you’ve signed a purchase agreement.

Depending on the lender, your rate will likely be locked in for 30-45 days, although it varies by lender. This rate lock is typically free of charges but, if it needs to be extended, fees may be charged. Make sure the rate lock period is long enough to cover the entire home buying process. If it takes you 60 days to close on a home but your rate is only locked in for 45 days, you’ll likely be faced with additional fees to extend the lock or you may lose the low rate all together. These fees may or may not be refundable. Talk to your real estate agent about the predicted amount of time it will take to close on your new home then, if you think you’ll need more time than the length of your rate lock, talk to your lender.

If you decide against a rate lock, you may choose to float your rate. When current rates are high, but there’s a chance rates will drop, floating your rate may be a good choice. The opposite is true if rates are climbing, which may lead to paying much higher than necessary rates. You can exercise your right to a lower rate only once and then your rate gets locked down. Also, there is a charge for a float down due to the additional cost to the lender. Terms of the float down are set by each lender so they will vary. For example, one lender may charge 1 point for a float down, while another lender may charge 1.6 points.

Whether you choose to lock in a rate or go with a float rate, get it in writing. When my husband and I were buying a home together, we talked to our lender and thought we had locked in a low interest rate. We put in an offer on a house, contacted the lender to let her know we were signing a purchase agreement, and discussed our low rate. Our lender denied having agreed to the low rate. Unfortunately, we did not get it in writing. After much discussion, we were able to convince her to give us a low rate, close to what we originally agreed on, after threatening to go with another lender. Save yourself the hassle of possibly losing a low rate by getting the lender to put it in writing.

You will be charged origination points and discount points when you take out a mortgage loan. Origination points, or origination fees, are charged by your lender to compensate the loan officer (ex. lender’s cost to process the loan). Lenders typically charge 1 origination point (1 point = 1 percentage of the loan) and these fees can usually be negotiated. The number of points vary per lender. For example, if you need a $150,000 mortgage loan, 1 point would cost you $1,500. Points will be listed on the Loan Estimate that you receive from your lender.

Mortgage points, or discount points, are charges paid directly to the lender in exchange for a lower interest rate. You will be paying for these points at closing. In essence, you pay some interest up front in exchange for a lower interest rate throughout the term of your loan. Less interest means you’re paying lower monthly mortgage payments. If you don’t plan on staying in the house for more than a few years or you plan on refinancing in a few years, paying for points isn’t a good idea. The real benefit of discount points is seen over the long haul.

Mortgage Application

A mortgage application is a document you use to apply to borrow money to purchase real estate. The document will include information about the home you wish to purchase along with information about your financial background. A lender will use this information to determine how much they will lend you, for how long and at what interest rate.

As part of the application process, your lender will look at your finances, including your housing expenses (mortgage, home insurance, taxes, condo fees, PMI if required, etc.). Housing expenses should be less than 35% of your pre-taxed income. The amount of your down payment is also an important part of this process. At this point, your lender will run a credit check give you an idea of how much they’re willing to loan you. Now that you know the approximate amount you can spend on a home, it’s time to start looking at houses.

Did you know your mortgage application can be rejected? A recent study by the Federal Reserve reflected 1 in 8 applications were denied. Your mortgage application could be denied for a variety of reasons, including lying on your form or one of the following:

- High debt-to-income ratio

- You recently applied for a new credit card

- You rarely use an existing credit card

- You recently switched jobs

- You have unpaid medical bills or missed payments

- You have been self-employed for less than 2 years

- You are not earning enough

- You don’t match the lender’s profile

- Your down payment cannot be verified

If you find yourself on the receiving end of a rejected mortgage application, talk to your lender to get a better understanding of why it was declined. For example, you may learn that you have bad credit, defaulted on a loan, or missed numerous credit card payments. Your lender can provide solutions for dealing with issues like this and working to improve your credit score.

If there are errors in your credit report, talk to the credit bureau (ex. EquiFax, TransUnion, Experian). They will investigate, correct it within 30 days, and notify you.

Once you’ve identified and fixed any problems, you will have a greater chance of being approved for a mortgage in the future.

There are other ways to quickly improve your credit score and get approved. The following options might play in your favor:

- Large down payment

- Collateral

- Get a cosigner (who has good credit)

- Try to get approved by a different lender

As was previously mentioned, a large down payment will save you from having to pay PMI, you’ll have lower monthly payments and will save you $1000’s on interest. Even if your credit isn’t perfect, lenders may be willing to loan more money if you can provide a large down payment.

When you use collateral as a down payment you’re essentially paying for the down payment with assets which can be liquidated for cash, equivalent to the 20% down payment. Collateral might include stocks, bonds, gold, land or others. Once you’ve signed a contract to purchase a home, get your asset appraised (might be unnecessary with stocks and bonds). You will then submit the appraisal to your lender. When you agree to use this asset as collateral, and sign off with the lender, you also agree to give up the asset if you default on your loan.

Factors such as income, credit, and financial history can prevent you from obtaining a mortgage and that’s where a cosigner might be your best option. A cosigner uses his good credit history to backup your credit history and help you secure a home loan. The cosigner becomes as legally responsible for the loan as you. In other words, if you were to default on the loan, the cosigner would be legally responsible for the debt.

When you apply for a mortgage and are denied, consider going with a different lender. Another lender may be willing to approve a mortgage based off of your financial history. Although, your best move would be to make some changes to your financial situation before scheduling an appointment. For example, look at your credit report closely in case a creditor made a clerical error. Report the error to your creditor and and get proof that the payment was made before approaching a new lender for a loan. If you decide to go to another lender after being denied a loan, keep in mind that every loan application shows up on your credit history which can be a red flag for some lenders.

6. Lender Criteria

Lenders will focus on two criteria to determine how much you can afford and how much of a credit risk you are -- the housing expense ratio (aka: front-end ratio or mortgage-to-income ratio) and the total debt-to-income ratio (aka: back-end ratio). The front-end ratio looks at how much you make each month in proportion to how much the mortgage will cost each month. In addition to the cost of the mortgage, it includes the cost of private mortgage insurance, homeowners insurance and property taxes. These costs are commonly referred to as PITI: Principal, Interest, Tax & Insurance. Lenders don’t want to see your monthly mortgage payment exceed 28% of your gross monthly income (31% or less for FHA loans). To calculate your front-end ratio, simply multiply your annual income by 0.28, then divide the amount by 12 to determine your maximum monthly mortgage payment.

Example: If your gross income is $44,000 per year

$44,000 x 0.28 = $12,320

$12,320 / 12 = $1,026.67

Based off of this equation, you would be able to afford a $1,026.67 maximum monthly mortgage payment.

If you have a higher than recommended front-end ratio, for example, 38% for a $1,045 monthly mortgage payment based off of earnings of $33,000/year, you would need to have other factors in place to be considered for a mortgage. A substantial down payment, sizable savings, and good credit scores can help those who have high front-end ratios.

The back-end ratio analyzes the percentage of gross income that must go towards debt payments like your mortgage, credit cards, car loans, student loans, medical expenses, and alimony, among others. This ratio helps lenders evaluate a borrower’s credit risk. Lenders prefer to see less that 36% of your monthly income going towards total debts, although if you have good credit, lenders may be a bit more flexible. The back-end ratio is determined using your income before taxes so you must take into consideration other expenses such as food, health insurance, gas, etc. In other words, you’ll want to budget beyond what the calculations consider “affordable”.

Back-end ratio = (total monthly debt expense / gross monthly income ) x 100

You can use an online debt-to-income ratio calculator to determine your score.

You’re considered a high-risk borrower if a high percentage of your paycheck goes to debt payments every month. For example, if you earn $1,200/month but pay $600 in monthly debt expenses, you would have a ratio of 50%. This exceeds the recommended minimum of 36%, but some lenders will make exceptions if you have good credit.

To lower your back-end ratio, avoid taking on more debt, avoid making big purchases on your credit card(s), and pay off as much debt as possible before applying for a mortgage. Your primary focus should be paying down or paying off high-interest credit card debt.

Remember, lenders are looking at both the front-end and back-end ratios when determining whether or not you qualify for a mortgage. The combination of both may prove to be in your favor even if one of your scores isn’t ideel.

7. Ways to Finance a Home

All-cash offers: Pros & Cons

Many of us will need to obtain financing in order to be able to purchase a home, but there are others who will be able to pay all-cash. If you have the means to pay all-cash for a home, be aware of the pros and cons. Some of the pros include the following:

- Very attractive for sellers

- May get a lower purchase price

- Avoid the hassle of getting a mortgage

- No mortgage payments

- No mortgage origination fees

- No mortgage interest payments

- No lender fees

- Faster closing

- Available equity

When you pay all-cash for a home, you get to bypass all of the pains that come with getting a mortgage then paying mortgage payments, interest, and origination fees.

Sellers may accept your offer over a higher-priced offer that requires a loan. Say you offer $325,000 all-cash on a home listed at $330,000. Even though you’re offering less than asking, your offer will likely be accepted over a full-asking offer with financing. Sellers know that an all-cash offer if more likely to close than an offer with loan financing. Plus, closing is faster.

When you buy with all-cash, you will be able to take advantage of immediate equity in your home. Equity is determined by the amount of money you put down when you purchase your home. When a buyer gets a mortgage loan and puts down a 20% down payment, they have 20% equity in their home. All-cash provides full equity in your home which can be used for renovations or to finance other expenses.

What about the cons associated with a full-cash offer? Because you’re paying out such a large amount up front, you may experience loss of liquidity. Make sure you have a considerable amount of money saved to cover emergencies because it’s difficult to access cash tied up in real estate. If you get into a financial bind, you may have to tap into equity or sell your home.

- Loss of liquidity

- Available funds for large, unexpected repairs

- Additional expenses: taxes, title insurance, appraisal fee, inspection fee, HOA fees

- Negate homestead exemption

Despite having paid all-cash, you’ll still have expenses like closing costs, real estate transfer taxes, fee for title insurance, appraisal fee, and the home inspection fee. Additional expenses might include having to pay monthly homeowners association (HOA) fees, used to fund property improvements and maintenance. These fees, which cost start around $200-$500/month, are usually associated with the purchase of a condo and some single-family communities. Although there are cons to consider when making a full-cash offer, paying cash will give you full ownership and many advantages.

Although the thought of paying all-cash for a home and not having a mortgage payment sounds like a good option, having a mortgage can come with the advantage of making money. When you have a mortgage payment that’s locked in, you may actually make money during inflationary periods. As inflation rises so does the value of your home. During an inflationary period, you earn more equity and your home-to-loan value increases -- all favorable perks of having a mortgage instead of paying all-cash for your home.

Homestead exemption may be negated without a mortgage, if you find yourself in serious debt in the future. If you paid all-cash for your home and filed a claim for homestead exemption, intended to protect your home's value from property taxes and creditors after the death of a spouse, creditors could force the sale of your home to satisfy their claims.

Mortgage Loan Options

Earlier we talked about getting approved for a mortgage loan. Now let’s take a look at the variety of mortgage loans that are available.

Conventional Loans

As the most popular type of loan today, conventional loans are not government-backed, guaranteed or insured by the government making them risky from a lenders’ standpoint. These loans are offered by private mortgage lenders and have conforming loan limits associated with them (ex. In 2019, $484,350 in most states; $726,525 in higher cost areas like Hawaii and Alaska).

The requirements for conventional loans are tougher making it more difficult to qualify for, in comparison to government loans (ex. strict income guidelines). They offer lower competitive rates and the down payment can be as low as 3% but can vary. Borrowers with excellent credit, and therefore a low risk of defaulting on the loan, are best suited for this type of loan. Borrowers may be required to complete an online course.

One of the most popular benefits of a conventional loan is no upfront mortgage insurance fee even if you put down less than 20%. However, there is a monthly mortgage insurance fee for those paying less than 20% down. You do not have to buy PMI if you put down 20%+.

A large majority of conventional loans are “conforming” mortgages because they conform to Fannie Mae and Freddie Mac guidelines. These two government-sponsored enterprises (GSEs) provide money for the U.S. housing market, buy mortgages and sell them to investors. This makes mortgages more widespread.

Let’s look at non-conforming loans, for those borrowers who don’t qualify for a conforming loan.

Non-conforming mortgage loans, which are also conventional loans, do not meet GSE guidelines. These loans are often called “jumbo” mortgages because they have larger loan limits than conforming loans. When borrowers don’t qualify for conforming mortgages, because the amount they need to borrow is higher than the conforming limit for the area, they might qualify for a non-conforming loan.

These loans are best for high-risk borrowers, those who have poor credit, a large amount of debt, recent bankruptcy, or for homes with a high loan-to-value ratio. Getting a loan that exceeds conventional loan limits, is more difficult to qualify for because the loan amount is high. Also, they may include fees or insurance requirements. Since they’re riskier, some lenders shy away from them. There are even super jumbo loans for loans on houses priced over $1 million.

“Portfolio” loans are non-conforming, flexible mortgages held by mortgage lenders on their books, hence “portfolio” in the name. Instead of working with a lender who services your loan from another location, you can maintain your relationship with the original lender. In other words, these loans aren’t sold to another lender, instead, the lender keeps the loan on his/her books and earns consistent interest on the loan. These loans are for people with bad credit, bankruptcies, foreclosures, tax liens or student loan debt, who wouldn’t qualify for a conventional mortgage. These loans may have features that other mortgages don’t because lenders can set their own guidelines and they don’t sell them to investors.

Subprime mortgages compliment buyers with low, less-than-favorable credit scores. The term subprime refers to a borrower’s credit score, usually below 600. These loans typically have high interest rates (often ARMs) and fees. These are geared toward buyers who have problems consistently making payments and are generally at higher risk of defaulting on their loans. Without these types of loans, people wouldn't be able to qualify for conventional mortgages. Borrowers are encouraged to work to improve their credit score so they can eventually qualify for a conventional loan, offering better interest rates and lower fees. Subprime mortgages can also fall under the following names:

- Near-prime

- Subpar

- Non-prime

- Second-chance lending

Conventional 97 loans are offered by Fannie Mae and are only given to first-time home buyers. There are loan limits associated with the loan which are typically set by your county. A fixed-rate mortgage is required and terms can be up to 30 years. There is no income limit and the loan doesn’t require the borrower to have perfect credit either. These loans only require a 3% down payment, leaving the buyer with a mortgage balance of 97% loan-to-value. The borrower’s FICO score typically needs to be 680+ and is dependent on the borrower’s financial profile. The borrower needs to have at least a 43% DTI (debt-to-income) ratio to ensure they don’t get in over their head after getting a mortgage.

- No income limit

- Do not have to have perfect credit

- 3% down payment

- 680+ FICO score

- 43%+ DTI

HomeReady mortgage loans are conventional loans offered by Fannie Mae. These loans aim to help low-to-moderate income borrowers, whether they’re first-time or repeat homebuyers. Credit scores need to be 620+, with higher scores typically result in better pricing. These loans are free from representations and warranties and are simple and quick to obtain if you qualify. A unique feature of this loan is that the borrower can cancel their mortgage insurance once equity grows to 20%.

These loans are flexible in allowing contributions from family and friends and there is no minimum personal contribution, which sets them apart from other types of loans. In other words, you can accept a larger down payment or closing costs in the form of a gift or grant.

Another unique feature of HomeReady loans is the income from others in your house can help you to obtain approval. In other words, rental or boarder income can help you get approved for this type of loan.

- Lower down payment

- Lower credit score requirements

- Lower mortgage insurance

- Family/friends can co-sign on your loan

- Accepts larger down payment and closing gifts

- Cancel mortgage insurance at 80% LTV

Government Loans

FHA loans are guaranteed by the FHA, have down payments as low as 3.5%, offer competitive rates, and are geared towards making homes more affordable for low- to middle-income families. These loans are favored because they have the lowest credit score requirements of any type of mortgage. Mortgage insurance premiums (MIP) are charged for this type of a loan. FHA mortgage limits vary state by state and are broken down by low-cost areas and high-cost areas (Alaska, Hawaii, Guam and the Virgin Islands).

- FICO score 580+, but a lower score may be accepted with a higher down payment

- Debt ratios should be 31% or less on the front end, 43% on the back end

- Borrowers may qualify for down payment assistance or grants

When a borrower has FHA mortgage insurance, they pay an upfront premium of 1.75% of the loan and they also pay annual premiums. With the upfront premium, the FHA gets paid by the lender at closing, then the lender adds the premium to the loan balance. Borrowers will pay mortgage interest on the premium until the loan is paid off. In addition, borrowers will pay annual premiums based on the length of the loan, the size of the down payment, and the size of the mortgage.

Once the buyer has paid debt down to 78% of the home’s value, with a 15-year FHA loan, the FHA will cancel your mortgage insurance. With a 30-year FHA loan, you’ll still need to pay debt down to 78% but will also have to make mortgage payments for at least 5 years before being able to cancel. FHA loans do not require an appraisal so if you pay your loan down to 78% you can cancel your insurance, even if the value of the home has declined (unlike PMI).

(Later in this article, we look at FHA loans called 203K rehab loans. These loans are geared toward properties in need of rehabilitation.)

VA loans are mortgages guaranteed by the U.S. Department of Veterans Affairs, designed for active military and veterans, and issued by private lenders. There are many benefits to VA loans including no down payment, low rates, 100% financing, and they don’t require mortgage insurance. These loans usually close in 40-50 days. You’ll need to find a lender that specializes in VA loans.

- Military, veterans and some spouses qualify

- $0 down payment

- Pay funding fee

- No PMI

VA loans also include funding fees. Funding fees are one-time fees used to offset VA loans that go into default, helping to reduce taxpayer costs, and allow the VA to continue to offer home loan programs to military homebuyers. This fee can be paid upfront or the borrower can have the fee calculated into their monthly mortgage payment. In some cases, borrowers with service-related disabilities can be considered exempt from paying funding fees. Others who may be exempt include the following:

- Those receiving disability compensation as a result of service-related medical issues

- Those on active duty who provide a certificate or military orders which show the Purple Heart award

- Those who are entitled to receive compensation for a service-connected disability, if they receive retirement pay in lieu of compensation or active duty pay

- Those rated as eligible based on a pre-discharge exam or review

- Surviving spouses of one who died in service, from a service-related cause, or totally disabled and receiving Dependency and Indemnity Compensation (DIC)

Reservists and National Guard members can expect to pay slightly less than other military members. Simply go online to use the free VA funding fee calculator to see what you might pay for a funding fee.

USDA loans, also known as rural development guaranteed housing loans or rural development loans, are designed for those with low to modest incomes wanting to buy rural/suburban properties (over 97% of the U.S. is eligible, although city homes are excluded). These loans require no down payment, 100% of the home’s purchase price can be financed, and mortgage rates are discounted.

- No down payment

- Low mortgage rates

- Fixed interest rate

- 15- or 30-year loan

- Low mortgage insurance fees

- No prepayment penalties

- FICO: 640 minimum

Borrowers must personally occupy the home as their primary residence, be a U.S. citizen / U.S. non-citizen / qualified alien, must not have been suspended or debarred from participating in federal programs, and must be willing to meet credit obligations in a timely manner (640+ credit score). Borrower’s DTI should be less than 41% of their income, although a good credit score could forgive a higher DTI. This type of loan can be used for an existing or new construction home. Talk to your real estate agent or lender or go online to see if you’re qualified.

Although USDA loans require mortgage insurance, the rates are low. When purchasing a home expect to pay a 1% upfront fee at closing, based on the size of the loan (ex. $100,000 loan requires a $1,000 upfront mortgage insurance premium). This mortgage insurance amount is added to your loan balance so you don’t have to hand over cash at closing. There is also a small 0.35% annual fee, based on the principle balance, for all loans. Following the example above, this would amount to a monthly fee of $29.17 added to your mortgage payment to cover mortgage insurance. (NOTE: closing costs can vary by state and lender.)

- 1% of the home loan upfront

- 0.35% annual fee on the loan amount

Even though USDA loans are for those with modest incomes, people with higher incomes can qualify using the 115% rule. For example, if the income limit is $60,000 for a family of 4, this family could be approved for $69,000 under the 115% rule.

You can visit the U.S. Department of Agriculture online to see if your area, or an area near you, is USDA-eligible. The site also lists lenders of the Rural Housing Program.

Piggyback Loan

It’s unusual to see piggyback loans today but they were popular during the mid-2000s, during the mortgage boom. A government-backed piggyback loan is a second mortgage loan made at the same time of the main mortgage which enables borrowers to avoid paying for private mortgage insurance. If a borrower only has enough for a small down payment (ex. 10%), they can get a piggyback loan to boost the borrowed amount to 90% of the price of the mortgage, hence avoiding PMI. This second mortgage will typically reflect higher interest rates which are often adjustable. Although it’s rare to hear of this type of loan today, there’s always a chance that it could make a comeback.

Interest-Only Loan

Another type of loan that’s unusual in today’s home buying landscape is an interest-only loan in which the buyer only pays interest on the mortgage. Most of these loans have a 30-year term. This type of loan appeals to buyers who want a bigger home than they can currently afford or they’re planning on selling within a few years. Some of the advantages of this type of loan include the following:

- Interest-only payments for up to 10 years (varies)

- Low monthly payments

- Monthly payments can be deducted from taxes

- Option for buyers who plan on selling within a few years

Most of these buyers using this type of loan are banking on earning more in the future so they can afford larger payments at the end of the fixed term, usually between 5-7 years. Once the term ends, borrowers begin paying off the principal of the loan, pay a lump sum, or refinance their home. Some borrowers will be shocked to learn how much of a payment increase occurs at the end of the fixed term.

Some of the disadvantages associated with interest-only loans include the following:

- Rising mortgage rates (if adjustable rate mortgage)

- Huge spike in monthly payment at end of interest-only period

- Borrowers spend the extra money they saved instead of investing it and being prepared for the end of the fixed term

- Borrowers income might not grow enough to enable them to afford larger payments when the time comes

Fixed-Rate and Adjustable-Rate Mortgages (ARM)

Loan programs typically offer the option of a fixed-rate or adjustable-rate (ARM) mortgage (also known as variable-rate). With a fixed-rate mortgage, your interest rate will remain the same for the life of your loan. With an ARM, your interest rate will start out low, lower than the interest rate for fixed-rate mortgages, but it can be changed periodically.

Examples of fixed-rate mortgages:

30-Year Fixed Rate: This is the most common term that homeowners choose. This rate will provide the lowest monthly payment and your rate will never change.

15-Year Fixed Rate: This rate will reflect higher monthly payments but more of the payment goes towards the principal balance. Your rate will be lower than a 30-year loan. One major benefit of a 15-year mortgage is paying off the loan in half the time, saving a lot in interest.

ARMs, also known as variable-rate mortgages, may start out with a low interest rate but then increase once you’re past the adjustment period. For example, you may be charged 3.25% interest your first year then pay 5% interest during the next adjustment period. This increase may increase the amount of your monthly payment and extend the life of your loan.

When you’re only planning on living in your home for a few years, an ARM might be a good option because you won’t be affected by interest rate changes for a very long period of time. On the other hand, if you plan on staying in your home for a long period of time, there’s a chance you could end up paying more than you borrowed, despite making all of your payments on time.

The initial rate on an ARM could last anywhere from 1 month to 5+ years, depending on the ARM product your choose. The term of an ARM is often time reflected in the name. For example, if you were to get a loan with an interest rate that changes every 3 years, you would have what’s known as a 3-year ARM.

Examples of ARMs:

5/1 ARM: The interest rate on a 5/1 ARM is fixed for the first 5 years of the loan and is generally low during that time. After 5 years, the rate will increase annually. These loans are typically for buyers who plan on staying in their home for less than 5 years or those who intend to pay off the loan in 5 years or less.

Interest-Only (I-O) ARMs: As the name implies, you only pay interest for a specific number of years with an interest-only (I-O) ARM payment plan. This will keep your monthly payments small for a period of time. The interest-only period on an I-O ARM can vary depending on your loan. Following the interest-only period, you will start paying back the principal along with the interest. The longer the I-O period, the higher your monthly payments will be after the end of the I-O period. This results in an increased monthly payment, even if interest rates stay the same. It’s important to know that some I-O loans can have adjustable interest rates during the I-O period.

With ARM’s, you’re assuming more risk over the long haul because interest rates will undergo scheduled changes throughout the life of your loan. Your monthly payments could go up or down and a lower interest rate might not result in a lower monthly payment. The rate is adjusted on the basis of an index which reflects the cost to the lender of borrowing on the credit markets. Be aware that different lenders may have the same initial interest rate, but different rate caps.

Fortunately, ARMs come with caps which limit the amount rates can change. Caps types are either annual or life-of-the-loan and save you money by capping the amount of interest that you’ll be charged over the life of your loan. With the annual cap, interest rate changes within any given year are restricted. The life-of-the-loan cap limits the maximum and minimum interest rate for the life of the mortgage.

Examples of ARM caps:

- Initial adjustment cap

- Subsequent adjustment cap

- Lifetime adjustment cap

- Periodic rate cap

The initial adjustment cap controls the maximum amount the interest rate on an ARM can jump when it is adjusted for the first time, after the period of fixed rate expires. This cap is typically 2% or 5%. At the first rate change, the new rate may not exceed two (or five) percentage points above the initial rate during the fixed rate period.

The subsequent adjustment cap is associated with interest rate increases in the adjustment periods that follow. A 2% cap is typically.

The lifetime adjustment cap controls how much, over the life of the loan, the interest rate may increase in total. 5% is most common. In other words, the rate would never be more than 5 percentage points above the initial rate.

A periodic rate cap on an ARM limits the change in your interest rate during the adjustment interval and is designed to safeguard the consumer (the adjustment period is the period of time between rate changes). For example, if you’re current rate is 6% and the periodic rate cap is 1%, your new rate must fall between 5-7%, regardless of index changes. If interest rates dropped or remained steady, you could save more than if you had a fixed-rate.

ARM components:

- An index

- A margin

- An interest rate cap structure

- An initial interest rate period

After the initial interest rate expires, adding a margin to the index will calculate a new interest rate. This margin will be disclosed by your lender when applying for a loan and can vary from lender to lender (shop around for the lowest margin). The index moves up or down, resulting in the adjustment of your interest rate. According to the FHA/HUD website, the following are acceptable index options on FHA insured ARM loans:

- Constant Maturity Treasury (CMT)

- 1-year London Interbank Offered Rate (LIBOR)

Your lender will provide written information on different types of ARMs, including the following:

- Loan terms and conditions

- Index and margin

- Rates and how they’re calculated

- How often rates changes

- Caps/limits on rate changes

- Other features

Talk to your lender to find out what the annual percentage rate (APR) is because if it’s a bit higher than your initial rate, you will likely pay a significantly higher amount payment as the loan adjusts, even if the general interest rates remain unchanged.

Before considering an ARM, think about other debts that may crop up (ex. tuition) that will affect your ability to pay a higher mortgage. An unexpected large expense could affect your ability to pay a higher mortgage if interest rates go up significantly.

If you aren’t planning on living in your new home for very long, you will likely be unaffected by rising interest rates and an ARM might make sense. For example, if your interest rate stayed the same for 2 years and then you decided to move, you would likely paid less interest than your friends who chose a fixed-rate mortgage.

Owner Financing

This is an interesting twist on getting financing for the purchase of a home. With owner financing, part or all of the money required to buy a property is put up by the current homeowner. In other words, the buyer is borrowing money from the seller to buy the seller’s home. Oftentimes, when lenders refuse to finance a seller’s property, owner financing becomes a useful option.

Owner financing may include a bank loan in combination with money borrowed from the seller. Some buyers will pay a down payment, although it isn’t required. A promissory note is created to cover the terms of the agreement between the buyer and seller. Terms include the interest rate, monthly payment and schedule, among others. These terms might be subject to local laws and regulations. If the entire purchase amount is being financed by the seller, they will keep the title until the buyer pays off the loan.

Owner financing benefits the seller in many ways. For starters, they can sell their home quickly. The seller can decide on the price of their home and sell it for more if they wish. Sellers will receive a steady stream of income as the buyer works to make payments. A seller will typically pocket more money because they aren’t paying fees associated with a lender agreement. A seller who is facing capital gains tax would also benefit from owner financing.

If sellers are dealing with a crowded market, owner financing provides an opportunity to be more competitive. An economic downturn can also be advantageous to the seller because, during that time, it’s difficult for buyers to get conventional financing and have enough money for a 20% down payment.

Buyers benefit from this type of financing as well. Owner financing includes little or no buyer qualifications, a variety of loan repayment options (ex. fixed-rate), lower closing costs (no origination points, processing fees, administrative fees, etc.), and faster possession. If a buyer can only get a small mortgage, the seller can lend the buyer the rest. If the seller requests a down payment, the buyer may only have to pay a small amount compared to what’s charged by lenders.

For sellers, there are downsides to owner financing including the buyer defaulting on the loan. If the seller still has a mortgage, he/she might face foreclosure. The seller needs to be organized in order to keep track of monthly payments and any late payments. Because of this, some home sellers hire a third party to collect the payments (additional fees will be paid for this type of service). Sellers must also take extra time to investigate the creditworthiness of the potential buyer. If the seller decides to hire a real estate attorney, they will have to pay fees.

Buyers face downsides too, including the possibility of paying a much higher interest rate than they would have if they had financed with a lender. For example, the seller might choose to charge a high interest rate if the buyer has a low credit rating. The seller might charge a large balloon payment at the end of the loan period which may cause financial hardship for the buyer. The buyer cannot sell or refinance the property until all payments have been made and the title has been transferred in their name.

As you can see, there are benefits and drawbacks to owner financing no matter if you are the buyer or seller. In either case, it’s best for both parties to hire real estate attorneys to make sure the financial agreement covers everything.

Programs for Specific Occupations or Profiles

- Law Enforcement Officers

- EMT’s

- Nurses

- Firefighters

- Teachers

- Veterans

- Low-to-Moderate Income

Certain occupations come with perks when it comes to home purchases. Law enforcement officers, for example, receive a 50% discount off of the appraised value of properties that have been foreclosed on by HUD (Department of Housing and Urban Development). If they purchase with a mortgage approved by the FHA, the down payment requirement is only $100. Teachers, firefighters and EMT’s can qualify for this program as well (some restrictions apply). In addition, assistance programs exist to provide grants or loans to cover down payments and closing fees.

- Good Neighbor Next Door

- Officer Next Door

- Teacher Next Door

- Keystone Challenge Fund

- State Housing Initiative Program

- Among others

Certain groups and populations (Ex. Native American) may be eligible for other discount programs sponsored by state and local governments or other organizations. Visit the HUD website to discover various programs offered in your state.

Low-to-moderate income households can take advantage of one or more of the following benefits:

- Below-market interest rates and payments

- Low down payment stipulations

- Grants and loans for down payments

- Mortgage insurance discounts

Some low-to-moderate income programs, like Freddie Mac’s Home Possible Advantage loan and Fannie Mae’s HomeReady program, offer low down payment options. The mortgage insurance associated with these loans is discounted too. If you’re buying a home outside of the city limits, you may qualify for a USDA mortgage (Rural Housing). A USDA mortgage requires no money down and includes 100% financing.

Veterans can take advantage of VA home loans, backed by the U.S. Department of Veteran Affairs. There is no minimum credit score, no down payment, you can finance 100% of the purchase price, there is no mortgage insurance, and sellers can pay up to 4% of the purchase price in closing costs so you may end up paying nothing out-of-pocket at closing.

As you can see, there are many discounts available for specific occupations and profiles. Let’s take a look at other programs, loans, and financing options to help you buy a home.

8. Down Payments

Although down payments have been mentioned throughout this article, this section will provide more details. A typical down payment is 5-20% depending on the loan. If you qualify for a FHA loan, for example, you will only have to pay 3.5% down. Overall, having a substantial down payment can save you from having to pay PMI on top of your monthly mortgage payment and from paying extra interest over the life of the loan.

Some believe that if you cannot afford at least 3% down, you might not be ready to own a home and accept the financial responsibility of home ownership. Dave Ramsey, financial guru, is a true believer in saving until you can afford 15-20% down on a 15-year fixed mortgage, where your payment is no more than a quarter of your take home pay. This advice is worth considering. Paying somewhere between 0.5%-5% of the original amount of your mortgage loan per year in mortgage insurance may prove too costly for some. On the other hand, if home buyers can afford to pay this percentage on top of the amount of their monthly mortgage, it’s worth it just to get into a home.

As mentioned earlier, the amount of your down payment helps your lender determine the loan-to-value (LTV) ratio of the property (how much you’ll owe after the down payment), and determines whether or not they’re going to extend credit to you. When you make a higher down payment, your lender will typically offer a better interest rate on the loan. Which translate to saving a lot of money over the life of the loan. Use a mortgage calculator to see how a large down payment can save you on interest over the life of your loan.

Some mortgages do not require a down payment. VA loans and USDA loans are good examples and they come with low rates. Talk to your lender to see if you qualify for these types of loans.

Funding a Down Payment

Various forms of down payment assistance exist including loans, grants, and tax credits. Some options will require repayment of funds, others will not.

Loans, for example, to help with a down payment may run in parallel with your main mortgage, offer deferred payments, or may be forgiven after a set number of years (under certain circumstances). There are a variety of second mortgage loans including the following:

- Soft second mortgage

- Deferred payment second mortgage

- Forgivable second mortgage

When loans run in parallel with the mortgage, as a second mortgage, the homebuyer may have varying payment options. Some may have deferred payments, others will pay for a portion or all of their down payment, others may be required to gradually pay back all funds as they’re paying off their first mortgage, or others may have to make monthly payments.

Soft second mortgage programs provide down payment assistance to get the homebuyer into the house quickly but require the borrower to repay the down payment. Some loans don’t include interest while others do, and some may amortize. The down payment term on repayable loans can range, on average, from 5- to 30-years with varying repayment terms. In some cases, repayment begins immediately. In other cases, repayment begins after a predetermined number of months or years. A partial balloon payment may be due at the end of the loan period.

Second mortgages, with deferred payments (aka: deferred or silent second programs) delay repayment of the down payment assistance until the borrower moves out, sells, refinances, or rents the home. If the home buyer plans on living in the house for many years, he/she will benefit from appreciation of the home’s value. When it comes time to sell, refinance, rent the home or move out, the homeowner may be faced with a 1099 tax form. Talk to your lender about this being a possibility so you’re prepared to deal with it should you receive one.

Other loans, known as forgivable second mortgage programs (aka: soft second), forgive some or all of the original down payment assistance amount. It’s similar to a grant but instead of providing a lump sum payment, funds are provided over a period of several years. With this type of short-term mortgage, it’s typical for a percentage of the second mortgage to be forgiven each year, for a fixed number of years. Much of the time these types of programs only last for 5 years. In that amount of time, the homeowner can build up equity which, in turn, helps them qualify for a standard mortgage when the forgivable second mortgage ends. If the borrower doesn’t meet the program’s conditions, the loan must be repaid, possibly with interest.

Other Considerations for Down Payment Assistance

Besides the information listed above, you can visit down payment resource programs online to see if you meet the minimum program qualifications. Some of the criteria you’ll be faced with are the following:

- Minimum credit scores

- Cash reserve requirements

- Income requirements and thresholds

Income thresholds are based on median income in the area. Household size is a common basis for determining income limits (ex. limits are higher for large families in comparison to a single person).