When you get a mortgage to buy a home, you will make monthly payments to gradually reduce the loan and eventually pay it off. An amortization schedule will provide you with the amount of your scheduled payments and how long it will take you to pay down the balance. Let's explore amortization and what your payments might look like.

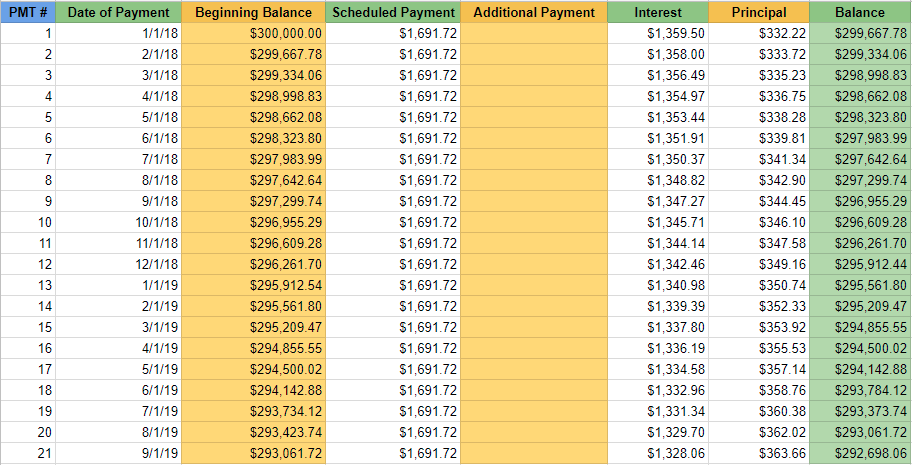

In the amortization table below, you can see a snapshot of the beginning of a payment schedule on a $300,000 loan. The loan illustrates scheduled payments, interest and principal, and the balance after each payment. The borrower pays off the loan in fixed installments ("scheduled payment" amounts remain the same), over a fixed period of time.

Principal & Interest

When you look at the amortized loan repayment schedule, you will see a column for principal and another for interest. Principal is the amount you borrow and agree to pay back. Interest is the cost you pay for borrowing the principal. During the first year of making payments, most of your payments will go toward interest. Over time, more of your payments will go towards the principal and help you build equity in your home.

15- vs. 30-Year Mortgage

Many borrowers will choose a 30-year mortgage over a 15-year mortgage because the monthly payments are traditionally lower. A 30-year mortgage generally comes with a higher interest rate, takes longer to pay off, but it will leave you with more cash flow at the end of each month to spend on other things. In addition, you'll have an option to refinance into a 15-year mortgage which is especially attractive when interest rates drop.

If you can qualify for a 15-year mortgage, you will typically get a lower interest rate which will save a lot of money over the life of your loan. Not only are you paying off the loan over a shorter period of time, you will pay less interest than on a 30-year loan (depending on interest rates). On the other hand, your monthly payments will be higher than a 30-year loan.

Buy a Home For Less Than You Were Qualified For

Just because a lender approves you for a $400,000 loan, doesn't mean you have to buy a home at that price -- it's ok to purchase a lower priced home. Remember, the lower the amount of the loan, the lower the payments and the less interest you'll pay (depending on the loan). For example, if you purchased a home for $350,000 instead of $400,000, you could save over $50,000 in interest alone (varies by interest rate). Using an amortization calculator will put the payments in perspective and possibly sway you toward a lower priced home.

Making Extra Payments

The amortization table also features an "additional payment" column. Consider making 1 extra payment each year and you will shave years off of your mortgage and save $1000's in interest. Instead of paying a full extra month in a lump sum, you could opt to pay 12 mini payments. Simply calculate the cost of principal and interest for a month and divide by 12 ($1680/12 = $140). If you can afford to pay an extra $140/mo., for example, you will save $1000's on your loan. As a bonus, extra payments will help you build equity faster. Talk to your lender about making extra payments to ensure the money goes toward the mortgage principal.

Conclusion

Now that you have a better understand of amortization, you can make a more informed decision about the amount of your monthly payments, interest, and how long it will take to pay off a mortgage. Remember, you can save a substantial amount of money over the long haul by simply making an extra payment each year or by paying a little bit extra each month. Armed with this knowledge you may have a better chance of winning a trivia game, as the title implies, but more importantly we hope it will get you one step closer to buying a home.