Out of the ⅓ of home buyers who were first-time home buyers in 2020, wouldn’t you like to be one of the most well-prepared? Knowing how much you need to save for a down payment and how much you can afford for a monthly mortgage payment will provide a great start to your house-hunting journey. Knowing how to stay within your budget can save you from financial hardship down the road. Let’s explore down payments and maximum mortgage payments as you prepare to buy your first home.

Over ⅓ of home buyers were first-time home buyers in 2020. - Statista

Down Payment

A down payment is your contribution toward purchasing a house, while the lender provides the rest of the money in the form of a mortgage loan. Saving for a 20% down payment can be challenging. Talk to your real estate agent about options if you’ve only saved a small portion of the 20% down payment. You may qualify to buy a house with as little as 3% down (0% as a veteran).

Check out our home buyer’s guide for more

information about down payment options.

If you find it challenging to save for a down payment, consider how much money you’re spending on unnecessary purchases. Are you buying new clothes every time you hear about a sale? Are you purchasing a latte each morning? The best way to get a handle on spending is to record everything you buy. Write down every purchase for 2-4 weeks. You might be surprised to learn how easy it could be to save an extra $100 a month toward a down payment just by cutting out frivolous purchases.

- You can buy a home with less than a 20% down payment

- Write down everything you’re buying and cut back on frivolous spending

- Down payment assistance and low-interest loans are available

Down payment assistance programs are also available for first-time home buyers. If you qualify for assistance, you could receive a grant or loan to cover all or part of your down payment. Check out this article for information about no down payment and low-interest loan options.

Maximum Mortgage Payment

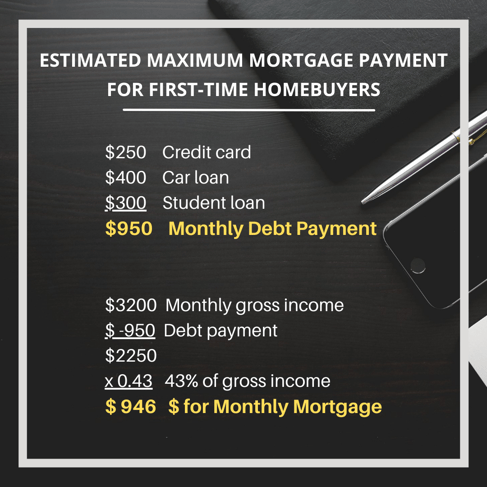

Knowing how much you can afford to pay for a monthly mortgage payment is another advantage when you’re preparing to buy a home. How do you determine your monthly mortgage payment? Start by comparing your monthly credit obligations to your monthly income. Credit obligations include the following:

- Car loans

- Credit cards

- School loans

- 401K contributions

- Other debt obligations

Add up your monthly debt payments, subtract them from your monthly gross income, and then multiply them by 43% to determine how much you could afford to pay each month toward a mortgage.

Your monthly mortgage payment shouldn’t exceed more than 43% of your monthly gross income (percentage can vary based on various loan options). In the example above, $946/month is the amount a person, with a $3200 monthly income plus debt, could afford to pay towards their mortgage without overextending themselves. To get the most accurate estimate of how much you could afford to put towards a monthly mortgage, speak to a lender.

Conclusion

Knowing how much you can afford to pay towards the down payment is a crucial first step in determining whether or not you can afford to purchase a home. Fortunately, down payment assistance is available for qualifying first-time homebuyers, as well as low-interest loans. Look at your daily and monthly spending to see where you can cut expenses and start saving more money. Lastly, calculate how much of a monthly mortgage payment you can afford, so you can rest easy knowing that you can comfortably afford to live in a new home.